There are plenty of good businesses that fail because they are convinced they must be great businesses.

When an entrepreneur asks me for advice for their company, the two most common questions I end up asking are, “what do you want to get out of this?”, and some variation of “do you really want to run a Startup, or would you be happier running a Small Business?” It’s not uncommon for people to make the mistake of thinking these types of companies are basically the same.

What’s the Difference and Why Does it Matter?

When you look at all of the new companies being created, the majority of these are Small Businesses. There are a few reasons for starting these, from following your passion, to having a reliable income, to perhaps creating a family business that will provide work for future generations. These companies are generally funded with family savings, small business loans, or personal loans. In almost all cases, the goal of these businesses is to be cash-flow positive and, if there is company growth, it is usually constrained by actual cash coming into the company, not spending ahead of revenue. As such, a Small Business will have revenue very early after starting, quickly as months or weeks. Owners are typically rewarded by the longevity of the company, a share of the profits, and sometimes a sale of the company.

When you look at all of the new companies being created, the majority of these are Small Businesses. There are a few reasons for starting these, from following your passion, to having a reliable income, to perhaps creating a family business that will provide work for future generations. These companies are generally funded with family savings, small business loans, or personal loans. In almost all cases, the goal of these businesses is to be cash-flow positive and, if there is company growth, it is usually constrained by actual cash coming into the company, not spending ahead of revenue. As such, a Small Business will have revenue very early after starting, quickly as months or weeks. Owners are typically rewarded by the longevity of the company, a share of the profits, and sometimes a sale of the company.

While you couldn’t tell from a survey of Silicon Valley, but only a very small percentage of new companies are Startups. These are companies that have a vision to discover some radical innovation, in a product, a process, or a service, that has the ability to win a huge market. Since this is an exercise in discovery, the path of a Startup is one of uncertainty and high risk, with 9 out of 10 of these companies failing. The uncertainly means Startups need risk capital (usually multiple infusions) and can take years before they have any revenue. The most common source of funding for these companies is Venture Capital. Proving a repeatable business model and massively scaling business is the goal of Startups. Owners (shareholders) are rewarded by a liquidity event where stock in the company is converted to cash, typically through an acquisition or by having an IPO, and trading stock on the public markets.

While you couldn’t tell from a survey of Silicon Valley, but only a very small percentage of new companies are Startups. These are companies that have a vision to discover some radical innovation, in a product, a process, or a service, that has the ability to win a huge market. Since this is an exercise in discovery, the path of a Startup is one of uncertainty and high risk, with 9 out of 10 of these companies failing. The uncertainly means Startups need risk capital (usually multiple infusions) and can take years before they have any revenue. The most common source of funding for these companies is Venture Capital. Proving a repeatable business model and massively scaling business is the goal of Startups. Owners (shareholders) are rewarded by a liquidity event where stock in the company is converted to cash, typically through an acquisition or by having an IPO, and trading stock on the public markets.

The differing goals, and the financing dynamics mean that Startups and Small Businesses operate almost opposite of each other. With cash being a critical resource in a Small Business, business decisions are typically risk adverse. In most cases the better decision will be one that keeps the business at break even rather than risk negative cash flow, even if that decision has a small chance of a huge positive change.

In contrast, since 9 out of 10 Startups fail, that last 1 has to not only deliver economic wins for itself, it has to carry the weight of the 9 others that didn’t (since investors actually want better than market returns over the several-year life of the fund, the real increase in value for a win needs to be closer to 30x). What kind of decisions lead to a 30x return on investment? Not the conservative, sane ones you want protecting the existing value of a Small Business. Investors need big returns and that means they need the company to take big risks.

Crossovers are Rare

Occasionally you will hear about company being run as a Small Business that is super successful has the outsized success of a Startup. More common is the Startup that has crossed-over to being a Small Business… in almost every case the crossover to Small Business represents a failure for investors, where the company established a sustainable business but not one that could generate liquidity. These companies are sometimes referred to as “zombies” by investors… won’t die, but the stock will never turn into cash. For Startups it is way more likely that they fail completely, burning through all cash in high-risk attempts before discovering an actual business. The lucky ones can become acquihires (where a company “acquires” the team as employees, but no real cash is spent). Acquires can be a decent outcome for some of the team, but it a failure for investors.

Know Thyself

And this gets back to my question to many entrepreneurs, “what do you want to get out of this?”

Too often an entrepreneur has shared his company with me and I’ve seen a good business – one that can pretty reliably grow at 10-15% per year, provide jobs for many grateful employees, have lots of happy customers, enable taking decent amounts of cash off the table as it grows, not require 60+ hour weeks to manage. That’s a pretty good outcome, but it is a Small Business, not a Startup.

A lot of entrepreneurs (especially in Silicon Valley), see Startup as the only option.

And, Startups are great, too! They change the world (usually with the intention of making it better), they risk death doing the crazy things that occasionally produce amazing results. And for those very few entrepreneurs that make it through the gauntlet, successfully deliver a revolutionary business, they are rewarded with substantial financial rewards and, occasionally, hero-like status. They’ve created a great business.

My advice to any entrepreneur starting the journey of building a company is understand what you want to get out of the company, from quality of life to financial reward, and understand if you want to build a Startup or a Small Business.

I would really like to have more great Small Business stories! If you are part of a Small Business or you know of a great Small Business, please leave a comment!

When asked, entrepreneurs don’t always recognize that their business model is an agency… they may see the unique customer work provided as building support in the underlying platform, or a way to help onboard early customers. While all possible, it’s unlikely, and VCs that have looked under the hood of hundreds of companies will understand the signals indicating this is an agency:

When asked, entrepreneurs don’t always recognize that their business model is an agency… they may see the unique customer work provided as building support in the underlying platform, or a way to help onboard early customers. While all possible, it’s unlikely, and VCs that have looked under the hood of hundreds of companies will understand the signals indicating this is an agency: If you do want to go the VC route and have a VC-sized exit, you’re going to either prove your business is the exception (unlikely), or make some fundamental changes to your business to achieve some combination of the following:

If you do want to go the VC route and have a VC-sized exit, you’re going to either prove your business is the exception (unlikely), or make some fundamental changes to your business to achieve some combination of the following:

Investment-backed startups are created to discover scalable businesses, usually by inventing a new product or service that can become a large business, or by creating substantial efficiencies that take customers away from an existing large business. There is no clear, obvious path to doing either of these, otherwise success would be the expectation, not the exception. So success requires reasonable self delusion that you will succeed, as well as experimentation / rapid iteration necessary to adjust to the challenges of discovering the successful business. In practice, this can often manifest itself as the CEO coming in with the crazy idea of the day saying, “let’s try this… can we ship it by tonight?” If you like the excitement that comes from working through challenges with great uncertainty, this process can be a rewarding experience.

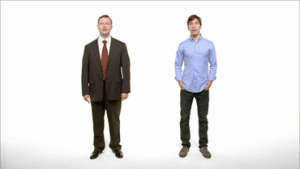

Investment-backed startups are created to discover scalable businesses, usually by inventing a new product or service that can become a large business, or by creating substantial efficiencies that take customers away from an existing large business. There is no clear, obvious path to doing either of these, otherwise success would be the expectation, not the exception. So success requires reasonable self delusion that you will succeed, as well as experimentation / rapid iteration necessary to adjust to the challenges of discovering the successful business. In practice, this can often manifest itself as the CEO coming in with the crazy idea of the day saying, “let’s try this… can we ship it by tonight?” If you like the excitement that comes from working through challenges with great uncertainty, this process can be a rewarding experience. Unfortunately, that particular type of person is usually the exact opposite of the particular type of person you want growing a scalable business. Growing a scalable business is more about efficiencies and optimization, much less about discovery. That same crazy idea of the day behavior that miraculously lead to discovering the scalable business is exactly what derails the consistency a company’s organizations need, and what customers will expect. As the organization grows, process and management becomes necessary to handle the challenges that come with simply trying to get hundreds of people to work towards the same goal. The needs of operating a scalable business probably contributed to the CEO quitting their previous job and creating the startup in the first place.

Unfortunately, that particular type of person is usually the exact opposite of the particular type of person you want growing a scalable business. Growing a scalable business is more about efficiencies and optimization, much less about discovery. That same crazy idea of the day behavior that miraculously lead to discovering the scalable business is exactly what derails the consistency a company’s organizations need, and what customers will expect. As the organization grows, process and management becomes necessary to handle the challenges that come with simply trying to get hundreds of people to work towards the same goal. The needs of operating a scalable business probably contributed to the CEO quitting their previous job and creating the startup in the first place. Your gut response as a startup entrepreneur is likely something like, “I’m going to make sure that doesn’t happen to me.” However, I encourage looking at it a different way… this happens, you’re probably going to be replaced, and that’s probably okay. It’s better to prepare for the possibility rather than assume it can’t happen. You may find being replaced is actually be the desired outcome if you prefer building new things rather than optimizing existing ones.

Your gut response as a startup entrepreneur is likely something like, “I’m going to make sure that doesn’t happen to me.” However, I encourage looking at it a different way… this happens, you’re probably going to be replaced, and that’s probably okay. It’s better to prepare for the possibility rather than assume it can’t happen. You may find being replaced is actually be the desired outcome if you prefer building new things rather than optimizing existing ones.