This week the Wall Street Journal published a story about third-party Google App Developers being able to read your Gmail, which was followed by many other outlets trying to sensationalize the news. However, a huge source of the exposing personal information problem isn’t big companies providing access to customer data, the problem is customers unwittingly (or uncaringly) granting permission for their data to be accessed. And while many people are skeptical about companies like Google and Facebook handling their data, the far bigger risk is users constantly exposing their private data to relatively unknown companies in exchange for low-value benefits.

Overreaching Account Access

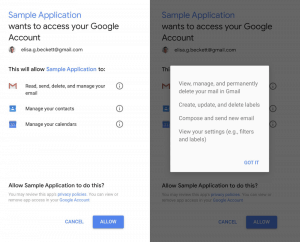

Many sites and applications allow you to sign-on through an account on Facebook, Google and other services. This process is known as single sign-on (SSO), and is convenient and generally secure, especially if you utilize improved security measures like two-factor authentication. However, some applications ask for more access than is necessary, and the user willingly exposes a lot of private data to a third party that they don’t really know.

The list of permissions presented when you first grant access can enable a third party perpetual access to your information, usually long after you forgot you granted permission.

If you are simply trying to login to a new application using SSO, there should be very little reason to grant any special permissions. Applications that request access to private data like email, contacts, messages, or calendars will have full access to your personal data. If an application doesn’t manage your private data, it should not need access. To protect your personal data, you should only provide the absolute minimum level of access necessary and avoid applications that request more that what they need.

Untrustworthy Third Parties

Some applications legitimately need elevated permissions to provide the service they offer, like inbox management, automatic scheduling, or even shopping deal comparisons. Many of these apps only access your data in the way necessary to provide the service, but there are many that take full advantage of access to your data and leverage your data for their benefit. According to articles on CNET and the Wall Street Journal, ReturnPath scanned the inboxes of 2 million people to collect marketing data after they’d signed up for one of the free apps produced by its partners, and the company’s employees read around 8,000 uncensored emails.

Some applications legitimately need elevated permissions to provide the service they offer, like inbox management, automatic scheduling, or even shopping deal comparisons. Many of these apps only access your data in the way necessary to provide the service, but there are many that take full advantage of access to your data and leverage your data for their benefit. According to articles on CNET and the Wall Street Journal, ReturnPath scanned the inboxes of 2 million people to collect marketing data after they’d signed up for one of the free apps produced by its partners, and the company’s employees read around 8,000 uncensored emails.

Even if you trust the intentions of the company producing the application, security is a really hard challenge and even the best companies fail at it… if you are providing access to an unknown startup, you are putting an exceptional amount of trust in believing they have the resources to ensure proper security measures. Of course, when a company is acquired (or its assets are sold), the access to your private data is passed along to the purchaser, whoever that might be.

When considering trading access to your private data in exchange for an application, ask what you are really getting for the risk. If somebody came up to you on the street and offered you some coupons in exchange for letting them read all of your email (forever), would you make that deal?

It’s Your Browser, Too

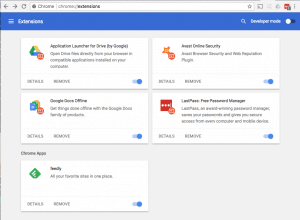

In addition to granting companies access directly, web browser extensions can expose data from every website you visit. These Extensions in Chrome, and Add-Ons, Extensions, and Plugins in Firefox, provide enhanced functionality from password management to page translation, ad blocking, and simple video downloads. To provide these services, many extensions get access to everything you do in the browser. For example, a news feed reader has permission to “Read and change all your data on the websites you visit” – this means every page visited and all content on that page is accessible by the news reader extension… your web mail, your Facebook messages, your dating sites, medical issues you research… all available to some company that organizes news headlines for you.

In addition to granting companies access directly, web browser extensions can expose data from every website you visit. These Extensions in Chrome, and Add-Ons, Extensions, and Plugins in Firefox, provide enhanced functionality from password management to page translation, ad blocking, and simple video downloads. To provide these services, many extensions get access to everything you do in the browser. For example, a news feed reader has permission to “Read and change all your data on the websites you visit” – this means every page visited and all content on that page is accessible by the news reader extension… your web mail, your Facebook messages, your dating sites, medical issues you research… all available to some company that organizes news headlines for you.

As browser extensions potentially grant access to every account, extra care should be taken to ensure trust for the company and permissions before installing.

Clean it Up and Lock it Down!

Until we make progress on time travel, there isn’t a way for an individual to guarantee deletion of data leaked from previously granted access. There are a few steps to greatly reduce your risk going forward…

Eliminate access to every app you don’t use

Most people simply stop using an app and forget about the access they granted, which usually continues in perpetuity. Regularly review the permissions you have granted – you will almost certainly find some surprises. Facebook has settings for Apps and Websites, Google has a great Security Checkup, and other SSO services usually have a way of reviewing apps with access to your data. Only allow access to apps you are regularly use, disable those you don’t, and review the permissions to ensure they match the access needed.

And do the same for browser extensions! If there are extensions you use infrequently, most browsers have the option to enable / disable instead of having to delete the extension, so you can easily grant access only when necessary.

Trust Before You Install

Installing applications and linked account creation on websites is simpler than ever. The downside to this ease of access is users typically spending little time scrutinizing the application. If you are giving access to your private data, spend the time to understand who is getting access, and how they will use your data. A simple web search for the application and “security” or “trust” can reveal what others experienced. If the company doesn’t have a website with the ability to contact them, and a published policy about handling your private data, there is a good chance securing your private data isn’t a real concern for them, and it should be for you!

Installing applications and linked account creation on websites is simpler than ever. The downside to this ease of access is users typically spending little time scrutinizing the application. If you are giving access to your private data, spend the time to understand who is getting access, and how they will use your data. A simple web search for the application and “security” or “trust” can reveal what others experienced. If the company doesn’t have a website with the ability to contact them, and a published policy about handling your private data, there is a good chance securing your private data isn’t a real concern for them, and it should be for you!

Did you actually check to see who you are sharing your private data with? If so, what is the craziest thing you found? Please share by leaving a reply, below!

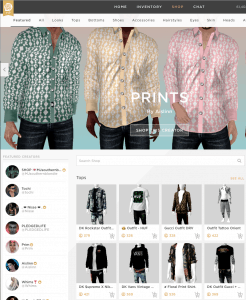

IMVU creates social products, connecting people using highly-expressive, animated avatars. A huge part of the value proposition is creativity and self expression, a lot of which comes from the customer’s choice of avatars and outfits. People are usually surprised to learn that the business generates well over $50 million annually. IMVU’s business model is based around monetizing that value proposition, as customers purchase avatar outfits and other customizations. However, IMVU doesn’t create this content, it is built by a subset of customers (“Creators”) for sale to other customers – IMVU provides the marketplace and facilitates the transactions. IMVU was the only entity that could create new tokens for the marketplace, so almost all of IMVU’s revenue was from customers purchasing tokens to buy virtual goods. This creates a true

IMVU creates social products, connecting people using highly-expressive, animated avatars. A huge part of the value proposition is creativity and self expression, a lot of which comes from the customer’s choice of avatars and outfits. People are usually surprised to learn that the business generates well over $50 million annually. IMVU’s business model is based around monetizing that value proposition, as customers purchase avatar outfits and other customizations. However, IMVU doesn’t create this content, it is built by a subset of customers (“Creators”) for sale to other customers – IMVU provides the marketplace and facilitates the transactions. IMVU was the only entity that could create new tokens for the marketplace, so almost all of IMVU’s revenue was from customers purchasing tokens to buy virtual goods. This creates a true  When there is a benefit to exploiting a system, people will try to exploit the system. Since the benefit in this system was real money, it didn’t take long for bad actors to surface. IMVU customers were being harmed by bad Resellers that would take their money and not provide tokens, or steal their accounts (and tokens). As a result, we locked-down the Reseller program to less than 20 trusted people and had requirements for them to maintain good practices to remain in the program. And things were good…

When there is a benefit to exploiting a system, people will try to exploit the system. Since the benefit in this system was real money, it didn’t take long for bad actors to surface. IMVU customers were being harmed by bad Resellers that would take their money and not provide tokens, or steal their accounts (and tokens). As a result, we locked-down the Reseller program to less than 20 trusted people and had requirements for them to maintain good practices to remain in the program. And things were good… The immediate pain comes from managing communication with a large, passionate community that benefits from the established system, doesn’t necessarily see the need for change, and doesn’t (and can’t) have the breadth of information necessary to understand why changes are necessary (and ultimately, beneficial). IMVU’s Community Manager made heroic efforts and did a great job with communication, but there were still massive forum threads, petitions, and doomsayers.

The immediate pain comes from managing communication with a large, passionate community that benefits from the established system, doesn’t necessarily see the need for change, and doesn’t (and can’t) have the breadth of information necessary to understand why changes are necessary (and ultimately, beneficial). IMVU’s Community Manager made heroic efforts and did a great job with communication, but there were still massive forum threads, petitions, and doomsayers. I knew the potential impact before making the decision, and exercised a lot of diligence researching the economy and token ecosystem (to be more accurate, I had an amazing COO that did the heavy lifting and we were aligned on our understanding). There were few decisions I made where I felt as confident in the ultimate result it would produce, but the timing, and seeing the painful business results each week certainly tested my confidence internally and I would review my assumptions to see where I could have gotten it wrong. Externally I remained more confident, reassuring employees and board we would see an inflection point… soon… it’s coming… hang in there.

I knew the potential impact before making the decision, and exercised a lot of diligence researching the economy and token ecosystem (to be more accurate, I had an amazing COO that did the heavy lifting and we were aligned on our understanding). There were few decisions I made where I felt as confident in the ultimate result it would produce, but the timing, and seeing the painful business results each week certainly tested my confidence internally and I would review my assumptions to see where I could have gotten it wrong. Externally I remained more confident, reassuring employees and board we would see an inflection point… soon… it’s coming… hang in there.

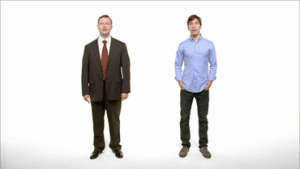

When you look at all of the new companies being created, the majority of these are Small Businesses. There are a few reasons for starting these, from following your passion, to having a reliable income, to perhaps creating a family business that will provide work for future generations. These companies are generally funded with family savings, small business loans, or personal loans. In almost all cases, the goal of these businesses is to be cash-flow positive and, if there is company growth, it is usually constrained by actual cash coming into the company, not spending ahead of revenue. As such, a Small Business will have revenue very early after starting, quickly as months or weeks. Owners are typically rewarded by the longevity of the company, a share of the profits, and sometimes a sale of the company.

When you look at all of the new companies being created, the majority of these are Small Businesses. There are a few reasons for starting these, from following your passion, to having a reliable income, to perhaps creating a family business that will provide work for future generations. These companies are generally funded with family savings, small business loans, or personal loans. In almost all cases, the goal of these businesses is to be cash-flow positive and, if there is company growth, it is usually constrained by actual cash coming into the company, not spending ahead of revenue. As such, a Small Business will have revenue very early after starting, quickly as months or weeks. Owners are typically rewarded by the longevity of the company, a share of the profits, and sometimes a sale of the company. While you couldn’t tell from a survey of Silicon Valley, but only a very small percentage of new companies are Startups. These are companies that have a vision to discover some radical innovation, in a product, a process, or a service, that has the ability to win a huge market. Since this is an exercise in discovery, the path of a Startup is one of uncertainty and high risk, with 9 out of 10 of these companies failing. The uncertainly means Startups need risk capital (usually multiple infusions) and can take years before they have any revenue. The most common source of funding for these companies is Venture Capital. Proving a repeatable business model and massively scaling business is the goal of Startups. Owners (shareholders) are rewarded by a liquidity event where stock in the company is converted to cash, typically through an acquisition or by having an IPO, and trading stock on the public markets.

While you couldn’t tell from a survey of Silicon Valley, but only a very small percentage of new companies are Startups. These are companies that have a vision to discover some radical innovation, in a product, a process, or a service, that has the ability to win a huge market. Since this is an exercise in discovery, the path of a Startup is one of uncertainty and high risk, with 9 out of 10 of these companies failing. The uncertainly means Startups need risk capital (usually multiple infusions) and can take years before they have any revenue. The most common source of funding for these companies is Venture Capital. Proving a repeatable business model and massively scaling business is the goal of Startups. Owners (shareholders) are rewarded by a liquidity event where stock in the company is converted to cash, typically through an acquisition or by having an IPO, and trading stock on the public markets.

IMVU had a culture of data-validated decisions from almost day one, and as a result we made it easy for anybody to create their own split test and validate the business results of their efforts. It took minutes to implement the split test and compare oh so many metrics between the cohorts. All employees had access to this system and we tested everything, all the time. A paper released in 2009,

IMVU had a culture of data-validated decisions from almost day one, and as a result we made it easy for anybody to create their own split test and validate the business results of their efforts. It took minutes to implement the split test and compare oh so many metrics between the cohorts. All employees had access to this system and we tested everything, all the time. A paper released in 2009, While numerous biases are working against you, with a buffet of metrics one of the most common is the

While numerous biases are working against you, with a buffet of metrics one of the most common is the

Within 24 hours of the breach I started receiving emails that threatened to release the customer data and publicly announce the breach if we didn’t pay a sum of money. My response to the blackmail was letting them know I would consider their proposal, but ultimately the damage they would do is to customers that didn’t deserve to be exploited, and to employees, good people that already feel a ton of weight from the responsibility. They gave me a few days to make a decision.

Within 24 hours of the breach I started receiving emails that threatened to release the customer data and publicly announce the breach if we didn’t pay a sum of money. My response to the blackmail was letting them know I would consider their proposal, but ultimately the damage they would do is to customers that didn’t deserve to be exploited, and to employees, good people that already feel a ton of weight from the responsibility. They gave me a few days to make a decision.

When asked, entrepreneurs don’t always recognize that their business model is an agency… they may see the unique customer work provided as building support in the underlying platform, or a way to help onboard early customers. While all possible, it’s unlikely, and VCs that have looked under the hood of hundreds of companies will understand the signals indicating this is an agency:

When asked, entrepreneurs don’t always recognize that their business model is an agency… they may see the unique customer work provided as building support in the underlying platform, or a way to help onboard early customers. While all possible, it’s unlikely, and VCs that have looked under the hood of hundreds of companies will understand the signals indicating this is an agency: If you do want to go the VC route and have a VC-sized exit, you’re going to either prove your business is the exception (unlikely), or make some fundamental changes to your business to achieve some combination of the following:

If you do want to go the VC route and have a VC-sized exit, you’re going to either prove your business is the exception (unlikely), or make some fundamental changes to your business to achieve some combination of the following:

Investment-backed startups are created to discover scalable businesses, usually by inventing a new product or service that can become a large business, or by creating substantial efficiencies that take customers away from an existing large business. There is no clear, obvious path to doing either of these, otherwise success would be the expectation, not the exception. So success requires reasonable self delusion that you will succeed, as well as experimentation / rapid iteration necessary to adjust to the challenges of discovering the successful business. In practice, this can often manifest itself as the CEO coming in with the crazy idea of the day saying, “let’s try this… can we ship it by tonight?” If you like the excitement that comes from working through challenges with great uncertainty, this process can be a rewarding experience.

Investment-backed startups are created to discover scalable businesses, usually by inventing a new product or service that can become a large business, or by creating substantial efficiencies that take customers away from an existing large business. There is no clear, obvious path to doing either of these, otherwise success would be the expectation, not the exception. So success requires reasonable self delusion that you will succeed, as well as experimentation / rapid iteration necessary to adjust to the challenges of discovering the successful business. In practice, this can often manifest itself as the CEO coming in with the crazy idea of the day saying, “let’s try this… can we ship it by tonight?” If you like the excitement that comes from working through challenges with great uncertainty, this process can be a rewarding experience. Unfortunately, that particular type of person is usually the exact opposite of the particular type of person you want growing a scalable business. Growing a scalable business is more about efficiencies and optimization, much less about discovery. That same crazy idea of the day behavior that miraculously lead to discovering the scalable business is exactly what derails the consistency a company’s organizations need, and what customers will expect. As the organization grows, process and management becomes necessary to handle the challenges that come with simply trying to get hundreds of people to work towards the same goal. The needs of operating a scalable business probably contributed to the CEO quitting their previous job and creating the startup in the first place.

Unfortunately, that particular type of person is usually the exact opposite of the particular type of person you want growing a scalable business. Growing a scalable business is more about efficiencies and optimization, much less about discovery. That same crazy idea of the day behavior that miraculously lead to discovering the scalable business is exactly what derails the consistency a company’s organizations need, and what customers will expect. As the organization grows, process and management becomes necessary to handle the challenges that come with simply trying to get hundreds of people to work towards the same goal. The needs of operating a scalable business probably contributed to the CEO quitting their previous job and creating the startup in the first place. Your gut response as a startup entrepreneur is likely something like, “I’m going to make sure that doesn’t happen to me.” However, I encourage looking at it a different way… this happens, you’re probably going to be replaced, and that’s probably okay. It’s better to prepare for the possibility rather than assume it can’t happen. You may find being replaced is actually be the desired outcome if you prefer building new things rather than optimizing existing ones.

Your gut response as a startup entrepreneur is likely something like, “I’m going to make sure that doesn’t happen to me.” However, I encourage looking at it a different way… this happens, you’re probably going to be replaced, and that’s probably okay. It’s better to prepare for the possibility rather than assume it can’t happen. You may find being replaced is actually be the desired outcome if you prefer building new things rather than optimizing existing ones.