Social networks, online communities, and social media are services we use because of the promise they offer to strengthen relationships with other humans. However, these services frequently fall short of that promise, sometimes harming the relationships they were meant to support. In many companies, delivering a negative customer outcome results in business failure, but for many social companies, negative customer outcomes are producing positive business results for product teams because the business success metrics are not aligned with customer success.

Or, maybe the metrics are perfectly aligned with customer success, but unfortunately, end users are not the customer. The argument, “If you’re not paying for it, you’re not the customer; you’re the product being sold” explains the poor outcomes for end users resulting in positive business results from customers (typically advertisers). I believe a great number of employees in these companies do think of you, the end user, as their customer, but the systems in place to validate a successful outcome fail to reinforce the importance of the customer’s needs outside of the business objectives.

It is common to hear social companies talk about being “customer obsessed”, and I have met plenty of Product Managers that genuinely care about the end user as their customer. But how many companies translate this obsession into their performance metrics to deliver an outcome that is truly successful for the customer? How often do you see companies reporting objectively measured progress towards delivering customer well-being? Engagement metrics like daily active users, ads watched, shares, retention, number of posts, and time spent in app are all very common… but without consideration of customer well-being, what do engagement-driven metrics deliver in a social product that if fundamentally about human relationships?

Show me the incentive and I will show you the outcome.

Charlie Munger

Worse Human Interactions

Many of the negative customer outcomes so many people experience correlate with a positive result for the companies creating the product. Disagreement, anger, and outrage all drive activity and engagement… since last week your posts increased 23% and your time spent in app is up by 8%, but you’ve also unfriended uncle Ned because he keeps posting fake political stories about your favorite candidate, and you disinvited your extended family from Thanksgiving.

But even positive content combined with effectively scorekeeping popularity through shares and likes, can lead to worse outcomes and lower self esteem as people tend to post their best moments, creating the perception that everybody else’s life is amazing, while you do laundry, eat leftovers, and watch Netflix alone.

Worse Decisions

Humans have many cognitive biases, error patterns in the way we think, leading to irrational decisions. Online we are regularly influenced by an availability cascade, overwhelming our critical thinking by making obscure or even crazy ideas seem rational as they are repeated and seemingly reinforced as widely accepted when we witness more and more people supporting the idea.

You watch one video because you are amused that a guy thinks the Earth is flat, and then your recommended feed is showing more support for his argument. Based on what is being presented to you, there seems to be a lot of support for this flat Earth idea. What seems like an obscure initial video you watched thinking it’s ridiculous that this guy thinks the Earth is flat has led you down the rabbit-hole of conspiracy videos, and you’re starting to think there might really be two sides to consider in this whole chemtrail thing, but good news, you’re watching 13 more videos and 72 more minutes than you did last week!

The poor outcomes don’t stop with the individual, they are reflected in negative outcomes for society overall. Misinformation about vaccines continues leading to a reduction in vaccination rates and new outbreaks of mostly-eradicated diseases. Unfortunately, sensationalized false claims can go viral quickly, while corrections get a small percentage of the original article, so the fake information gains a substantially larger public mindshare.

Balancing Business Metrics with Customer Empathy

For many businesses, validating successful customer outcomes is relatively straightforward… reducing their cost per widget, increasing their leads, reducing time spent in a business process are all objective benefits. But for products that are fundamentally about human relationships, a successful customer outcome is more subjective, but by most definitions of healthy relationships, is not based on dependency, quantity of consumption, or other common assessments of engagement.

What metrics might a company consider if customer well-being were a consideration in the successful customer outcome? Factors like happiness, growth, confidence, personal enrichment, support, safety, and fulfillment seem like good candidates. In customer interviews, this would also mean understanding the real answer to the question, “How do you feel after using our product?“

Customer Well-Being is Measurable

The subjective nature of metrics like “customer happiness” presents a challenge. However, technology is reaching a point where it is becoming possible, at scale, to more objectively answer the question, “how does my customer feel?”. Sentiment analysis of text has matured considerably, and can be used understand customer. Similarly, emotion recognition of voice and visuals can provide insights into the immediate reactions. Technologies like these are being applied to problems predicting depression from written text and speech. Wearables with biometrics are becoming increasingly common and also provide an opportunity to assess the physical impact from online interactions.

Further reinforcing that measuring customer well-being is possible, in 2018 the New York Times piloted ad placements based on the emotions certain articles evoke. However, like many current applications of sentiment analysis, this use case emphasized the value created for the advertiser, focusing on targeting the customer with premium-priced ads when the customer is in an emotional state that is optimal for the advertiser. The examples cited targeted upbeat, inspired customers, but it is easy to imagine the same technology could be used to target customers that are upset, reactionary, and likely more susceptible to radical suggestions. In other words, perfect for divisive political targeting.

An encouraging example of prioritizing customer well-being comes from Dan Seider at Stigma, using input from webcam images, regularly processed by artificial intelligence to understand online consumption impact on happiness. If this type of customer data can be secured (likely requiring it to never leave the customer’s device), this technology could lead to solutions that help people understand how their online habits are benefitting or harming their well-being. While empowering individuals with these sort of tools is great, it represents third-parties trying to provide protections from social products, rather than social companies considering customer well-being as part of their product success.

Codify Better Social Outcomes

From a business results perspective, there is little need for the current social giants to change. A couple of times a years we see news surface where customers are outraged by being exploited, manipulated, or endangered, a CEO repeats a statement about fixing things, and the market value of these companies generally continues to increase in spite of these problems.

I believe many CEOs are sincere in their desire to eliminate the social problems manifested in their products (I mean, who wouldn’t want that to go away), but I don’t see this desire supported with how the company objectively assesses success, and I am skeptical we will actually see improvements until customer well being metrics are considered alongside of engagement metrics. A commitment to results requires measurement, and cultural integration into what is considered success, from product performance to employee incentives. If you don’t track it, you probably don’t really care about it.

For earlier stage social products and companies with a commitment to better customer outcomes, it is easy to assume that strong product leadership holding this commitment is enough to stay on that path. Codifying what a better social outcome means will help make the path clear when there are inevitable product tradeoffs between short-term gains vs. long-term enduring value for customers. As new employees join the company they will see values like “we love our customers” not just as words painted on the wall, but as a requirement for success.

Does your product team include customer well-being as a desired outcome? I’d like to hear more, especially how success is measured – please leave a reply below!

Credits

Kids in Field on Laptops image by Unknown, via Pxhere

Blockhead Toy image by Unknown, via Pxhere

Girl on Playground image by Unknown, via Pxhere

Computer Draining Man image by Unknown, via Pxhere

Excited Kids on Laptop image by Unknown, via Pxhere

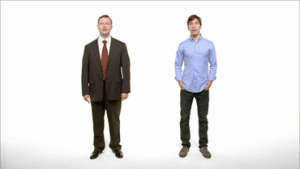

When you look at all of the new companies being created, the majority of these are Small Businesses. There are a few reasons for starting these, from following your passion, to having a reliable income, to perhaps creating a family business that will provide work for future generations. These companies are generally funded with family savings, small business loans, or personal loans. In almost all cases, the goal of these businesses is to be cash-flow positive and, if there is company growth, it is usually constrained by actual cash coming into the company, not spending ahead of revenue. As such, a Small Business will have revenue very early after starting, quickly as months or weeks. Owners are typically rewarded by the longevity of the company, a share of the profits, and sometimes a sale of the company.

When you look at all of the new companies being created, the majority of these are Small Businesses. There are a few reasons for starting these, from following your passion, to having a reliable income, to perhaps creating a family business that will provide work for future generations. These companies are generally funded with family savings, small business loans, or personal loans. In almost all cases, the goal of these businesses is to be cash-flow positive and, if there is company growth, it is usually constrained by actual cash coming into the company, not spending ahead of revenue. As such, a Small Business will have revenue very early after starting, quickly as months or weeks. Owners are typically rewarded by the longevity of the company, a share of the profits, and sometimes a sale of the company. While you couldn’t tell from a survey of Silicon Valley, but only a very small percentage of new companies are Startups. These are companies that have a vision to discover some radical innovation, in a product, a process, or a service, that has the ability to win a huge market. Since this is an exercise in discovery, the path of a Startup is one of uncertainty and high risk, with 9 out of 10 of these companies failing. The uncertainly means Startups need risk capital (usually multiple infusions) and can take years before they have any revenue. The most common source of funding for these companies is Venture Capital. Proving a repeatable business model and massively scaling business is the goal of Startups. Owners (shareholders) are rewarded by a liquidity event where stock in the company is converted to cash, typically through an acquisition or by having an IPO, and trading stock on the public markets.

While you couldn’t tell from a survey of Silicon Valley, but only a very small percentage of new companies are Startups. These are companies that have a vision to discover some radical innovation, in a product, a process, or a service, that has the ability to win a huge market. Since this is an exercise in discovery, the path of a Startup is one of uncertainty and high risk, with 9 out of 10 of these companies failing. The uncertainly means Startups need risk capital (usually multiple infusions) and can take years before they have any revenue. The most common source of funding for these companies is Venture Capital. Proving a repeatable business model and massively scaling business is the goal of Startups. Owners (shareholders) are rewarded by a liquidity event where stock in the company is converted to cash, typically through an acquisition or by having an IPO, and trading stock on the public markets.

IMVU had a culture of data-validated decisions from almost day one, and as a result we made it easy for anybody to create their own split test and validate the business results of their efforts. It took minutes to implement the split test and compare oh so many metrics between the cohorts. All employees had access to this system and we tested everything, all the time. A paper released in 2009,

IMVU had a culture of data-validated decisions from almost day one, and as a result we made it easy for anybody to create their own split test and validate the business results of their efforts. It took minutes to implement the split test and compare oh so many metrics between the cohorts. All employees had access to this system and we tested everything, all the time. A paper released in 2009, While numerous biases are working against you, with a buffet of metrics one of the most common is the

While numerous biases are working against you, with a buffet of metrics one of the most common is the

When asked, entrepreneurs don’t always recognize that their business model is an agency… they may see the unique customer work provided as building support in the underlying platform, or a way to help onboard early customers. While all possible, it’s unlikely, and VCs that have looked under the hood of hundreds of companies will understand the signals indicating this is an agency:

When asked, entrepreneurs don’t always recognize that their business model is an agency… they may see the unique customer work provided as building support in the underlying platform, or a way to help onboard early customers. While all possible, it’s unlikely, and VCs that have looked under the hood of hundreds of companies will understand the signals indicating this is an agency: If you do want to go the VC route and have a VC-sized exit, you’re going to either prove your business is the exception (unlikely), or make some fundamental changes to your business to achieve some combination of the following:

If you do want to go the VC route and have a VC-sized exit, you’re going to either prove your business is the exception (unlikely), or make some fundamental changes to your business to achieve some combination of the following:

Investment-backed startups are created to discover scalable businesses, usually by inventing a new product or service that can become a large business, or by creating substantial efficiencies that take customers away from an existing large business. There is no clear, obvious path to doing either of these, otherwise success would be the expectation, not the exception. So success requires reasonable self delusion that you will succeed, as well as experimentation / rapid iteration necessary to adjust to the challenges of discovering the successful business. In practice, this can often manifest itself as the CEO coming in with the crazy idea of the day saying, “let’s try this… can we ship it by tonight?” If you like the excitement that comes from working through challenges with great uncertainty, this process can be a rewarding experience.

Investment-backed startups are created to discover scalable businesses, usually by inventing a new product or service that can become a large business, or by creating substantial efficiencies that take customers away from an existing large business. There is no clear, obvious path to doing either of these, otherwise success would be the expectation, not the exception. So success requires reasonable self delusion that you will succeed, as well as experimentation / rapid iteration necessary to adjust to the challenges of discovering the successful business. In practice, this can often manifest itself as the CEO coming in with the crazy idea of the day saying, “let’s try this… can we ship it by tonight?” If you like the excitement that comes from working through challenges with great uncertainty, this process can be a rewarding experience. Unfortunately, that particular type of person is usually the exact opposite of the particular type of person you want growing a scalable business. Growing a scalable business is more about efficiencies and optimization, much less about discovery. That same crazy idea of the day behavior that miraculously lead to discovering the scalable business is exactly what derails the consistency a company’s organizations need, and what customers will expect. As the organization grows, process and management becomes necessary to handle the challenges that come with simply trying to get hundreds of people to work towards the same goal. The needs of operating a scalable business probably contributed to the CEO quitting their previous job and creating the startup in the first place.

Unfortunately, that particular type of person is usually the exact opposite of the particular type of person you want growing a scalable business. Growing a scalable business is more about efficiencies and optimization, much less about discovery. That same crazy idea of the day behavior that miraculously lead to discovering the scalable business is exactly what derails the consistency a company’s organizations need, and what customers will expect. As the organization grows, process and management becomes necessary to handle the challenges that come with simply trying to get hundreds of people to work towards the same goal. The needs of operating a scalable business probably contributed to the CEO quitting their previous job and creating the startup in the first place. Your gut response as a startup entrepreneur is likely something like, “I’m going to make sure that doesn’t happen to me.” However, I encourage looking at it a different way… this happens, you’re probably going to be replaced, and that’s probably okay. It’s better to prepare for the possibility rather than assume it can’t happen. You may find being replaced is actually be the desired outcome if you prefer building new things rather than optimizing existing ones.

Your gut response as a startup entrepreneur is likely something like, “I’m going to make sure that doesn’t happen to me.” However, I encourage looking at it a different way… this happens, you’re probably going to be replaced, and that’s probably okay. It’s better to prepare for the possibility rather than assume it can’t happen. You may find being replaced is actually be the desired outcome if you prefer building new things rather than optimizing existing ones.

For the most part, the state of employment agreements and employee intellectual property rights hasn’t changed. Many companies still have policies with far-reaching claims on anything the employee creates, at any time, even if not directly related to the business and whether or not company resources were utilized. It doesn’t matter that some of these claims are not enforceable (in particular, California has much more employee-friendly laws), many employees would simply give up rather than incur the legal costs to defend their rights.

For the most part, the state of employment agreements and employee intellectual property rights hasn’t changed. Many companies still have policies with far-reaching claims on anything the employee creates, at any time, even if not directly related to the business and whether or not company resources were utilized. It doesn’t matter that some of these claims are not enforceable (in particular, California has much more employee-friendly laws), many employees would simply give up rather than incur the legal costs to defend their rights. Standard Employee Agreements (which include assignment of intellectual property) are heavily weighted in favor of the employer and, since they are pretty much the same at every company, there is no competitive market and little reason to change. The company’s fear of losing out on an amazing invention can also come into play, with concerns that the company will forfeit rights to what could have been a game-changing development (who wants to be the idiot that let go of the billion dollar idea?). And finally, lawyers… corporate counsel provides tried-and-true boilerplate Employee Agreements, and the same corporate counsel that reviews the policy change is typically risk-averse, seeing rights-releasing changes as mostly downside with unknown benefits.

Standard Employee Agreements (which include assignment of intellectual property) are heavily weighted in favor of the employer and, since they are pretty much the same at every company, there is no competitive market and little reason to change. The company’s fear of losing out on an amazing invention can also come into play, with concerns that the company will forfeit rights to what could have been a game-changing development (who wants to be the idiot that let go of the billion dollar idea?). And finally, lawyers… corporate counsel provides tried-and-true boilerplate Employee Agreements, and the same corporate counsel that reviews the policy change is typically risk-averse, seeing rights-releasing changes as mostly downside with unknown benefits.